John S.

We love Terina! She saved us a ton of money on our house and auto insurance.

We love Terina! She saved us a ton of money on our house and auto insurance.

Very polite respective representatives who do all that they can to make you have have the absolute best coverage for the best possible cost.

Such a pleasure to work with Lancaster Insurance. Terina will find you the best rate and helps you save money.

I highly recommend Terina Lancaster. She is such a fantastic agent to work with – a true professional. Terina has excellent communication and timely follow up. She is very experienced, dedicated to great client care and can help you find the right policy for any of your insurance needs.

Terina is wonderful to work with. She is always looking out for her customers. She is attentive to your needs, always available and on top of all that she actually makes house (or business) calls. Yes, she comes to you. Terina has really made my life easier and less complicated by making it possible to work with one agent for personal home and auto as well as commercial. I highly recommend you have her review your current policy. When I did she ended up saving me money and even increased my coverage in the process.

Terina is a great person to work with. I recall a couple of years ago she helped me lower my renter’s and homeowner’s insurance and is available to help anyone. I would highly recommend Terina and give her a call and she will work with you. She very much enjoys helping people.

I was very dissatisfied with Geico. After hitting a deer, I called them to find out that my old Subaru did not have the coverage I needed to cover the damage. Terina was fantastic! Not only did she get me full coverage soup to nuts but also added renter’s insurance. The best part?? She saved me a bunch of money by switching to Lancaster Insurance Center! I pay less now for everything than I did when I had Geico and just-auto. I also got a brand-new car and still pay less with Lancaster Insurance Center.

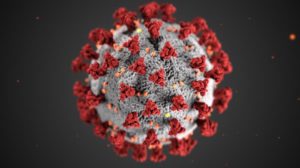

Our world has changed since the spread of the corona-virus (COVID-19). Life as we once knew it does not exist, at least for now. Instead our life and world has changed since the spread of this pandemic called “corona-virus (COVID-19).” Since the end of March, we have been in what I like to call “lock down,” also known as “self-isolation,” and two months later here we are finally starting the phase to gradually end the lock down and slowly resume life as we once knew it. While life is slowly resuming this does not mean we do not still have to practice social distancing or wearing our face mask. Who would have ever thought we would be wearing face masks out in public to prevent the risk of spreading or contracting the virus – even if we don’t have the virus wearing the mask is respectful to others, even if you don’t like it. Today, we are maintaining social distancing and wearing face masks, parents are now home school teachers, essential workers are teleworking from home – while font-line essential workers have to leave their home to go to work every day and risk their health and life as well as their family.

Our world has changed since the spread of the corona-virus (COVID-19). Life as we once knew it does not exist, at least for now. Instead our life and world has changed since the spread of this pandemic called “corona-virus (COVID-19).” Since the end of March, we have been in what I like to call “lock down,” also known as “self-isolation,” and two months later here we are finally starting the phase to gradually end the lock down and slowly resume life as we once knew it. While life is slowly resuming this does not mean we do not still have to practice social distancing or wearing our face mask. Who would have ever thought we would be wearing face masks out in public to prevent the risk of spreading or contracting the virus – even if we don’t have the virus wearing the mask is respectful to others, even if you don’t like it. Today, we are maintaining social distancing and wearing face masks, parents are now home school teachers, essential workers are teleworking from home – while font-line essential workers have to leave their home to go to work every day and risk their health and life as well as their family.

I like to take a moment to personally say THANK YOU to all our Healthcare Workers, Doctors, Nurses, EMT’s, Law Enforcement, Fire Fighters and Grocery Store workers for all YOU have done for us. You are out there every day risking your health and life to save ours. Let us not forget about our grocery store workers who are making sure the shelves are well stocked with food and supplies for us. If you have not said “Thank You” to any of these Essential Front-line workers, would you today? It is about making a difference and impact on a person’s life and putting a smile on both of your faces. It does not have to be a grand gesture; it can be as simple as a wave or a smile to show that you care. During times like this it is nice to know you are appreciated.

Who would have ever thought we would be living in an era of a pandemic? Having to raise our children or grandchildren through this is even more difficult in times like this. If you have young children, I can only imagine how hard this is on them. Young children do not understand why they cannot have a birthday party or play with their friends or go to school, etc. It is not only difficult and challenging for adults, it also is for young children as well.

While it is vital for people to stay home on lock down, I have noticed how communities are coming together to help their neighbors and local businesses. It is the act of kindness that can make a big difference during these difficult and challenging times. One thing I have noticed is the nice gesture local Law Enforcement, Fire Departments and EMT’s are making by coming forward to help make a child’s birthday special or a day special for an elderly person. If it is your birthday or special day, why not make a lot of noise. The children love seeing the flashing lights and hearing the sirens, we know that children would prefer a birthday party with cake and ice cream and presents to open.

In recent years High School and College Graduates celebrate commencement with a ceremony in achieving their milestone, and afterwards a BIG celebration thrown by their parents with family and friends. For these graduates walking across the stage is not just about a celebration, it is about the recognition of all their hard work, sacrifices that they have made and their achievements. This year will be especially hard for many graduates for many different reasons. Graduation ceremonies will be different or challenging due to the pandemic of COVID-19.

In recent years High School and College Graduates celebrate commencement with a ceremony in achieving their milestone, and afterwards a BIG celebration thrown by their parents with family and friends. For these graduates walking across the stage is not just about a celebration, it is about the recognition of all their hard work, sacrifices that they have made and their achievements. This year will be especially hard for many graduates for many different reasons. Graduation ceremonies will be different or challenging due to the pandemic of COVID-19.  This year is especially heartbreaking, so many missed opportunities to celebrate achievements and milestones for high school seniors. This was their last year to do all the fun stuff seniors love to do, such as senior prom, senior trip, senior week, senior awards ceremony/banquet, and graduation. Let us not forget about our College graduate, for them this is also a milestone. It is a celebration and momentous time for them and their family, especially if they are the first in their family to attend college and graduate. This is a difficult time for any High School Senior and College Graduate, this is the most important milestone of their life. In honor of our High School and College graduates ‘Class of 2020,’ I would like you to know this is YOUR YEAR!

This year is especially heartbreaking, so many missed opportunities to celebrate achievements and milestones for high school seniors. This was their last year to do all the fun stuff seniors love to do, such as senior prom, senior trip, senior week, senior awards ceremony/banquet, and graduation. Let us not forget about our College graduate, for them this is also a milestone. It is a celebration and momentous time for them and their family, especially if they are the first in their family to attend college and graduate. This is a difficult time for any High School Senior and College Graduate, this is the most important milestone of their life. In honor of our High School and College graduates ‘Class of 2020,’ I would like you to know this is YOUR YEAR!  How is your community coming together in celebrating high school and college graduates or graduation ceremonies?

How is your community coming together in celebrating high school and college graduates or graduation ceremonies?

Motorcycles can be as pricey as vehicles – there are some motorcycles that are priced on the low end. Do you know what the 10 most expensive motorcycles are for 2020?

When it comes to motorcycle type everybody has a specific style they like. Here are six main categories that are recognized:

When it comes to motorcycle type everybody has a specific style they like. Here are six main categories that are recognized:

When it comes to motorcycle insurance the question I most often hear is, why is the insurance premium so high? Motorcycles are much riskier to drive than most vehicles or other transportation. When it comes to motorcycle insurance, insurance companies consider a multitude of factors, such as type of motorcycle, age, riding history, tickets and/or accident and claim history, coverage’s, location, and credit.

Stay safe and enjoy your ride.

Wedding insurance is special event insurance that protects a couple’s investment that are beyond their control. Wedding insurance protects you from losses that may arise due to any unforeseen circumstance.

Various factors that may occur –

Wedding insurance policy coverage’s

Wedding insurance policy coverage’sLiability Insurance – Wedding liability insurance covers damages to the venue or injuries to guests.

Liquor Liability – This is optional wedding day coverage that can protect against on premises alcohol-related accidents that can result in your liability. (Check to see if liquor liability is included or is an optional coverage in your policy.)

Cancellation or postponement coverage – Wedding Insurance cancellation coverage helps protect you from financial loss if your event needs to be canceled or postponed due to family illness, extreme weather, bride or groom being called for military deployment, or some other unexpected reason.

What Does Wedding Insurance Cover?

A wedding policy will cover about anything outside of you control that will ruin your big day. There are some things that a wedding policy will not cover.

It’s a good idea to purchase your wedding insurance as soon as your start incurring expenses. Keep in mind, there may be restriction when you may be able to purchase cancellation coverage – often no later than 15 days before the event but no sooner than two years prior. You may be able to purchase liability coverage up to one day prior to the event.

Hopefully your wedding day goes of just as you planned but having wedding insurance provides you with security and peace of mind so you can focus on getting ready for your big day.