What Coverage Do You Need for Restaurants and Food Service Business? August 2019

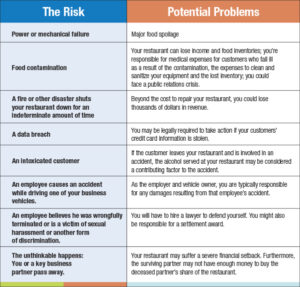

If you own a restaurant or have thought about opening a restaurant, as with any business it takes allot of time and energy, not to mention blood, sweat, and tears, and allot of perseverance in getting it up and running. There are some unique risks involved when it comes to insuring a restaurant. Workers can or will get injured, patrons could get sick, cooling systems may break down, and the list goes on. It’s important to make sure you are adequately protected with business insurance in the event something major happens. Setbacks due to fire, theft or other unexpected life events may be hard to recover from, especially before you’re turning a profit.

The greatest chance of success in the food-service business is to make sure your restaurant can handle a financial loss due to things beyond your control. Here are some tips.

Basic Coverage’s

Business Owner’s Policy provides insurance for your property, liability and loss of income due to a loss on your business.

- Property: Provides coverage for your building (owned or rented, additions or additions in progress and outdoor fixtures). Covers your business personal property for damage or loss, kitchen equipment and inventory, including perishable foods. Commercial property insurance provides reimbursement if a fire damages your kitchen, even if a fire started in another building. It provides coverage for vandalism, theft, and certain types of weather-related damage, such as burst pipes and hail damage.

- Liability:Protects against lawsuits related to a customer’s injury or damage to a customer’s property that happened at your place of business. General liability insurance can help pay for medical expenses, pay for repair or replacement of customer’s property if damaged and help pay for court costs, attorney’s fees, and other legal expense if a customer holds you liable. General liability provides coverage against advertising injuries, including defamation (libel and slander) and accusations of copyright infringement.

- Business interruption: In the event of a loss this coverage will help make up for lost income and pay other related expenses to help you reopen. It covers loss of income due to a fire or other catastrophe that disrupts the operation of your business. It can also include extra expense of operating out of a temporary location.

Other Coverage’s

- Liquor liability:If your bar or restaurant serves alcohol you may be required to purchased liquor liability insurance, it can be added to a business owners’ policy. This coverage protects your business in the event an intoxicated customer injures another customer’s property or causing injury to someone due to consuming too much alcohol at your business.

- Commercial auto insurance:Can cover expenses related to accidents involving a business-owned vehicle. It provides coverage for vehicle theft and vandalism. If your restaurant provides delivery service on a regular basis, make sure you have a commercial auto policy in place.

- Worker’s Compensation:This policy is required in most states for business with one or more employees. It provides coverage for medical expense and partial lost wages if an employee is injured on the job.

- Food spoilage and contamination: Whether it’s due to a malfunctioning refrigerator or a power outage, damage to your stored food can be a big financial loss to your business. This type of coverage will help you recover from the damage. It provides coverage to help reimburse the cost of replacing spoiled frozen or refrigerated food, or shelved perishables. Food contaminated by a supplier or improper handling may also need to be thrown away. Food contamination coverage helps with replacement costs, along with associated cost such as cleaning or advertising to restore your reputation. Food spoilage and contamination coverage can both be added to commercial property insurance on your BOP.