Blog

Commercial property insurance – what’s covered, what’s not covered

Commercial property insurance is meant to help guard the physical assets of your business from specific perils, such as fire, explosions, storms, burst pipes, vandalism, and theft. It protects your building and business personal property, along with fences, signs, and other exterior fixtures. It is a core coverage of your business insurance policy.

If you have commercial property insurance coverage for your business, then you know you are covered for several risks. Did you know that there are common damages that are excluded from your coverage under commercial property insurance policies?

Commercial Automobile Accidents

Commercial property insurance does not cover your company’s vehicles that are used in your daily business. For your company’s vehicles to be covered you need commercial auto insurance. The purpose of commercial auto insurance is to protect you by making sure you are covered for both damage to your vehicles and bodily injury or property damage resulting from an accident caused by a driver.

Flood or Earthquake Damage

Flood and earthquake coverage are excluded from your business insurance policy, as it is with homeowner’s insurance. To protect your company from these risks you need commercial flood insurance or earthquake insurance for your business. If your company is in a flood zone or any prone area for earthquakes, our experienced agent will help you find the best price with the coverage you need.

Equipment Breakdown Coverage

Commercial property insurance protects against damage caused by a covered peril, such as fire, theft, vandalism or explosion. It does not cover damage that has incurred by equipment breakdown or malfunction. Unless equipment breakdown insurance is included in your business insurance package, the cost of repair or replacement will come out of your company’s pocket.

Off-Premises Power Failure

A utility failure, such as an electrical outage or a disruption in water service, could force your business to close for a day or even longer. This type of loss is not covered under your commercial property insurance. You may be able to add off-premises coverage caused by a covered peril resulting in a loss of power as an endorsement to your policy.

Excluded Property Coverage

There are certain types of property that are excluded under a commercial property insurance, including:

- Money, security, accounts, bills

- Land, piers, docks, and wharves

- Vehicles, aircraft, and watercraft (with certain exceptions)

- Animals other than stock

- Crops, hay, or grain located outside

- Cost of excavation, grading, or back-filling

- Building foundations

- Walkways, roads, and other paved surfaces

- Electronic data

- Cost of restoring information on valuable records

Meet with an Agent

One of your responsibilities as a business owner is to ensure you are adequately protected with the right business insurance coverage. Commercial property insurance does not cover everything, it is possible to purchase other coverage to help fill in those gaps. Our experienced insurance agent would be happy to meet with you to review your business insurance policy. We will advise you on the types of insurance coverage you need for your company to be adequately protected and to help you find the right coverage to provide you peace of mind, and affordability.

Blog

When purchasing you’re auto insurance you may not be sure what coverage you need. One coverage you should not be left without is towing and labor. Did you know that towing and labor is not costly and is worth having?

What is towing and labor?

Towing and Labor is also called “emergency road service.” It’s meant to help you when your broken down or in a bind. Towing and Labor is provided by all auto insurance companies.

Did you know some insurance companies automatically include this coverage in your policy premium? While other insurance companies allow you to add it on your policy.

How can towing and labor help me?

Let’s say you’re cruising down a country back road — no worries in the world, wind blowing through your hair, singing your favorite tune — suddenly, your car sputters, chugs, and slowly… just … stops. Uh-oh. You turn on your hazard lights and pull over to the side of the road. Then you remember (with a sigh of relief) that you’d added towing and labor coverage to your car insurance policy for just-in-case moments like these. You may not know what’s wrong with your car, however you can have peace of mind knowing what’s included in your towing and labor coverage.

There are certain occurrences that are typically covered up to the limits on your policy, regardless of which company you choose; such as:

- Towing (when it’s not related to an accident)

- Locksmith services if you get locked out

- Tire changes and jump starts

- Mechanical labor at the breakdown site

Of course, not all roadside service plans are created equally, so no matter where you buy your coverage, it’s important to ask your licensed agent and/or read the fine print when purchasing your policy.

Blog

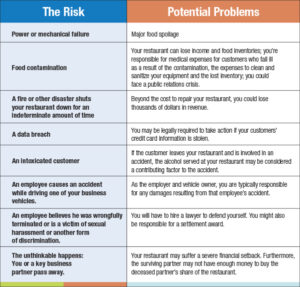

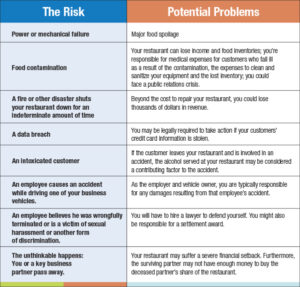

If you own a restaurant or have thought about opening a restaurant, as with any business it takes allot of time and energy, not to mention blood, sweat, and tears, and allot of perseverance in getting it up and running. There are some unique risks involved when it comes to insuring a restaurant. Workers can or will get injured, patrons could get sick, cooling systems may break down, and the list goes on. It’s important to make sure you are adequately protected with business insurance in the event something major happens. Setbacks due to fire, theft or other unexpected life events may be hard to recover from, especially before you’re turning a profit.

The greatest chance of success in the food-service business is to make sure your restaurant can handle a financial loss due to things beyond your control. Here are some tips.

Basic Coverage’s

Business Owner’s Policy provides insurance for your property, liability and loss of income due to a loss on your business.

- Property: Provides coverage for your building (owned or rented, additions or additions in progress and outdoor fixtures). Covers your business personal property for damage or loss, kitchen equipment and inventory, including perishable foods. Commercial property insurance provides reimbursement if a fire damages your kitchen, even if a fire started in another building. It provides coverage for vandalism, theft, and certain types of weather-related damage, such as burst pipes and hail damage.

- Liability:Protects against lawsuits related to a customer’s injury or damage to a customer’s property that happened at your place of business. General liability insurance can help pay for medical expenses, pay for repair or replacement of customer’s property if damaged and help pay for court costs, attorney’s fees, and other legal expense if a customer holds you liable. General liability provides coverage against advertising injuries, including defamation (libel and slander) and accusations of copyright infringement.

- Business interruption: In the event of a loss this coverage will help make up for lost income and pay other related expenses to help you reopen. It covers loss of income due to a fire or other catastrophe that disrupts the operation of your business. It can also include extra expense of operating out of a temporary location.

Other Coverage’s

- Liquor liability:If your bar or restaurant serves alcohol you may be required to purchased liquor liability insurance, it can be added to a business owners’ policy. This coverage protects your business in the event an intoxicated customer injures another customer’s property or causing injury to someone due to consuming too much alcohol at your business.

- Commercial auto insurance:Can cover expenses related to accidents involving a business-owned vehicle. It provides coverage for vehicle theft and vandalism. If your restaurant provides delivery service on a regular basis, make sure you have a commercial auto policy in place.

- Worker’s Compensation:This policy is required in most states for business with one or more employees. It provides coverage for medical expense and partial lost wages if an employee is injured on the job.

- Food spoilage and contamination: Whether it’s due to a malfunctioning refrigerator or a power outage, damage to your stored food can be a big financial loss to your business. This type of coverage will help you recover from the damage. It provides coverage to help reimburse the cost of replacing spoiled frozen or refrigerated food, or shelved perishables. Food contaminated by a supplier or improper handling may also need to be thrown away. Food contamination coverage helps with replacement costs, along with associated cost such as cleaning or advertising to restore your reputation. Food spoilage and contamination coverage can both be added to commercial property insurance on your BOP.