Blog

Auto | Home | Business

Despite what you may think, an insurance review doesn’t have to be as involved or a time-consuming endeavor. A conversation or a visit with your agent can help make sure you’re knowledgeable about your insurance coverage and comfortable that your limits are meeting your current needs.

When the bill arrives in the mail to pay your insurance premiums, this should prompt a reaction to review your policy. Insurance policies can be changed to accommodate changes in your life or circumstances. Many consumers don’t understand what coverage they have and could be uninsured or paying more than they need in insurance premium. Reviewing your insurance premiums and coverage should be done annually. Failure to do this could result in paying higher premium or a headache down the road.

Home

When your homeowner’s insurance is up for renewal, it’s important to review each piece. Even if you haven’t made any significant developments or improvements to your home, it is possible that other changes have occurred that your insurance agent should know about. Changes in the real estate market may affect the current policy or changes in lifestyle, living situation, or income are all factors to consider when reviewing your homeowner’s policy.

Auto

Auto insurance policies should be reviewed to ensure you have adequate coverage and protection for all drivers. If you have a new driver on your policy, it may be a good time to increase coverage. In addition to adding or changing the vehicles on your policy, it is important to review your driving habits. Are you driving more compared to last year or less? Will you have any upcoming road trips that may require additional coverage? If the value of your car has dipped below $2,500 it may be a good time to remove collision coverage and have liability only. If you take the time to review these aspects each year, it will help save you money and provide you with peace of mind.

Business

When small business owners are focused on the day-to-day activity of a growing business, it can be hard to realize all the small changes occurring that may affect insurance rates. Perhaps you have purchased new equipment, additional vehicles, or developed new products or services. On the other hand, if your business is struggling and has lost money, you may want to lower your policy limit in order to accommodate a reduced value. This will also reduce your premium and save you a little money.

Blog

When purchasing you’re auto insurance you may not be sure what coverage you need. One coverage you should not be left without is towing and labor. Did you know that towing and labor is not costly and is worth having?

What is towing and labor?

Towing and Labor is also called “emergency road service.” It’s meant to help you when your broken down or in a bind. Towing and Labor is provided by all auto insurance companies.

Did you know some insurance companies automatically include this coverage in your policy premium? While other insurance companies allow you to add it on your policy.

How can towing and labor help me?

Let’s say you’re cruising down a country back road — no worries in the world, wind blowing through your hair, singing your favorite tune — suddenly, your car sputters, chugs, and slowly… just … stops. Uh-oh. You turn on your hazard lights and pull over to the side of the road. Then you remember (with a sigh of relief) that you’d added towing and labor coverage to your car insurance policy for just-in-case moments like these. You may not know what’s wrong with your car, however you can have peace of mind knowing what’s included in your towing and labor coverage.

There are certain occurrences that are typically covered up to the limits on your policy, regardless of which company you choose; such as:

- Towing (when it’s not related to an accident)

- Locksmith services if you get locked out

- Tire changes and jump starts

- Mechanical labor at the breakdown site

Of course, not all roadside service plans are created equally, so no matter where you buy your coverage, it’s important to ask your licensed agent and/or read the fine print when purchasing your policy.

Blog

Educating Teen Drivers

As a parent we worry about our teen driving and it’s our job to educate them on the rules and laws of safe driving. Before your teen hits the road set these “5 to Drive” rules.

- No Cell phones while driving

- No extra passengers

- No speeding

- No alcohol

- No driving or riding without a seat belt

Continue to practice driving with your teen even after they obtain their drivers license. The more you practice driving with your teen the more experience they will have behind the wheel and will reduce the likelihood of an accident. The reason there are so many accidents with teen drivers is due to inexperience driving. Teen drivers struggle with judging gaps in traffic, driving the right speed for conditions and turning safely, among other things.

Facts

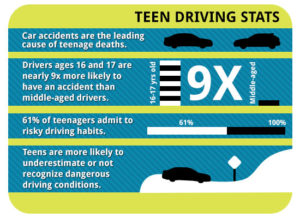

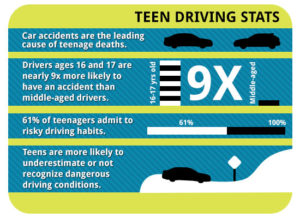

- In 2016 there were 2,433 teens ranging in age between 16-19 that were killed. There were 292,742 teens treated in emergency departments for injuries suffered in a motor vehicle crash.

- Motor vehicle crashes are the leading cause of death for U.S. teens? Every day 1 in 8 teens ranging in ages 16 – 19 are killed in a motor vehicle accident.

- Teen drivers between the ages of 16 to 19 are more likely to be in a fatal crash compared to 20 and older adult.

- 16-year-olds have higher crash rates than drivers of any other age.

- Half of all teens will be involved in a car accident before they graduate high school.

Statistics

- 56% of teens have said they talk on the phone while driving. Talking on a cell phone can double the likelihood of an accident as well as slow the teen’s reaction time down to that of a 70-year-old.

- 53% of teen deaths occur from auto crashes between Friday and Saturday and weekend prime time. Teen crash fatalities occur between 9 a.m. an 12 a.m. in general.

- 32% of teen driver fatalities is contributed to speeding.

- 20% of fatal car crashes involving teenager’s alcohol was a factor.

- 47% of teen driver killed in car accident weren’t wearing a seat belt.

- Statistics show that 16 and 17-year old driver death rates increase with each additional passenger.

- 1 in 5 of 16- year old drivers will have an accident within their first year of driving.

- 16- to 17-year old drivers are nine times more likely to be involved in a crash than adults and six times more likely to be involved in a fatal crash than adults.

What can we do as a parent?

- Set a good example. Your behavior is greatly influenced by your teen when it comes to driving. Practice safe driving habits yourself, especially when your teen is in the car with you. Refrain from talking on the cell phone, speeding, disobeying traffic signs and unsafe driving behaviors. Set the example for your teen when it comes to driving. What message do you want to send your teen?

- Talk to your teen about the driving risks. Share statistics regarding teenage driving fatalities and the risk factors that contribute to them. Talk to your teen about the danger of drug and alcohol use while driving under the influence and tell them it’s against the law. Let your teen know the impact and ramifications it will have on them.

- Continue to practice driving with your teen. Your teen passed their permit and road test. This does not mean they are an experienced driver. Parents should continue to practice safe driving with their teen. This is a great way to spend time together while helping them improve on their driving skills.

Blog

What is Umbrella Insurance?

What is Umbrella Insurance?

Umbrella insurance is an additional liability insurance that will protect you financially in the event you are sued for a large amount of money. It provides additional coverage if you are faced with costs due to a liability claim. Umbrella policies provide coverage in excess of your auto, homeowners, boat, or business and can be applied to all if you have these policies bundled. Umbrella insurance will step in when your primary insurance coverage isn’t enough.

What does umbrella cover?

An umbrella policy provides two types of coverage: liability and defense costs. Umbrella policies will cover an excess of what your primary insurance excludes and/or additional coverage beyond the limits set in your other insurance. It provides coverage for a variety of situations if your held responsible for bodily injury, property damage, or personal injury. An umbrella policy will help pay for these liability-related costs.

What does Umbrella insurance not cover?

Umbrella policies do not cover physical property damage. It does not cover damage to your own home or vehicle; for e.g. someone steals everything in your house, or a hailstorm totals your car; an umbrella policy will not step in as coverage. This would fall under your homeowners or auto insurance coverage.

What does personal umbrella insurance cover?

- Defense cost – If you are sued your umbrella insurance coverage steps in to pay for lawyer fees and processing expenses that will help defend yourself in court. Any remainder umbrella coverage not used for defense cost may help pay for any associated liability expense you owe.

- Teen Drivers – Did you know the crash risk is 3x higher for 16-19-year old, and teens account for about 8-10% of fatal crashes every year. This creates high risk and high liability. Having umbrella insurance coverage boosts your auto liability limit to protect against these increase risks. Teen drivers typically raise your insurance premiums. Having an umbrella policy is a great way to provide additional coverage at a lower cost, rather than adding the extra line of liability on your primary auto insurance.

- Intoxicated party attendee – You host a party or a BBQ cookout at your house. One of your guests drinks too much and is intoxicated. Your guest leaves your party and, on his/her drive home causes an accident. Depending on your state, you may be partially liable for his/her expenses. A lawyer could make the claim you over served him and did not cut him off, you did not stop him from leaving by taking his keys, offering him to stay the night, or offer to call a taxi/cab. People don’t realize one of the most surprising and expensive liability claims they find themselves in is indirect liability. Umbrella insurance coverage can help protect against this when homeowners’ insurance likely won’t.

- Dog bites – Do you own a dog? You walk your dog and another dog spooks him. Both dogs get into a fight, and your dog bites that dog. Your dog also bites the other dogs’ owner while in the mist of pulling the dogs apart. This would cause bodily injury to both the owner and the dog. If your dog bites first or attacks person your will be responsible for medical expense, lost wages and even pain and suffering. This may not be covered by homeowner’s insurance, especially if you have a dog that is on the excluded dog list, such as a Chow, German Shepherd, Pitbull, Rottweiler, Akita and there are a few more. Umbrella insurance coverage could step in to pay for the costs.

- Pain and suffering – You have an accident and are found at-fault for the incident. You could be sued for “pain and suffering.” Pain and suffering is one of the costliest liability expenses. It could lead to hundreds of thousands if not millions of dollars in some cases. Umbrella insurance coverage can help cover these costs; the minimum umbrella limit is $1 million.

Blog

Did you know, how your drive your auto whether it’s for personal or business depends on the type of policy you should have? Most people do not understand the importance of Business Auto Insurance.

Why business auto insurance v. personal auto insurance?

There are several differences between business auto and personal auto insurance. A business auto will have higher liability exposure to a risk than a personal auto. A business auto will carry a much higher liability limit in coverage than a personal auto. Business auto provides other coverage’s that personal auto does not, such as:

- Property and liability trailer exposure

- Equipment used with or attached to the vehicle

- Additional insured requirements

- Higher limits (up to $2 million)

- Loading and unloading exposure

- Hired-vehicle coverage

- Non-owned vehicle coverage

Did you know?

If you own a vehicle that is insured under a personal auto insurance policy and use if for business, you need a commercial business auto policy.

Did you know?

An insurance company may not pay claims for any damages you incur, if the insurance company deems it was used in the course of business as a commercial vehicle.

Why is it important to discuss with your agent how you use your vehicle?

In order to select the right policy coverage for your vehicle business auto or personal auto, it is important that you disclose how you plan on using your vehicle. This will help to prevent any claims issues.

How do I know if my car should be on a personal or commercial insurance policy?

If you use your car for any business-related purpose, you need a commercial auto insurance policy.

Did you know how to classify a commercial vehicle?

Your auto is classified as a commercial vehicle if you use it to:

- Pick up or deliver any goods,

- Provide a service for a fee,

- Travel to remote work location or between work locations,

- Visit client locations.

- Haul goods for a service

Additional conditions which your car may be classified as a commercial vehicle:

- The owner’s name is listed on the vehicle title as a business – incorporated, unincorporated or LLC,

- The vehicle is rented or leased by others

- The vehicle is equipped with a snow plow, has an altered suspension system or other equipment or modification

- The vehicle is used for a landscaping business

- Is driven by you or your employees for both business and personal use on a regular basis.

If you use your personal vehicle occasionally for business use, it may be covered under your personal auto insurance. I would discuss with your agent how you plan on using your vehicle, whether it’s for personal or business usage. Your agent will advise you as to the appropriate policy is for your situation.